Silver in now in the limelight amid new U.S. Tariff Regime and Strong Fundamentals

Why Silver Is Capturing Attention

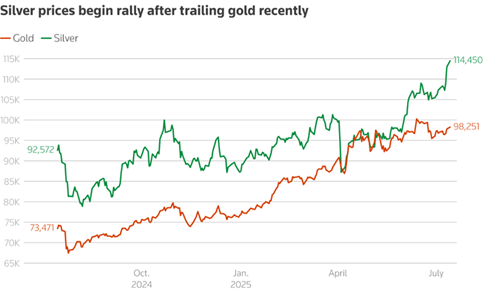

New U.S. tariff measures have revived fears of stagflation and disrupted supply chains, prompting investors to seek refuge in precious metals. Gold responded immediately, and silver followed—benefiting not just from its safe-haven status but also its industrial demand profile.

(Image source: Reuters)

The gold-to-silver ratio remains historically elevated, pointing to silver’s relative undervaluation. A reversion toward long-term norms often results in silver outperforming. This dynamic is drawing investor interest and inflows. (Image source: Crescat capital)

3. Persistent Supply Deficit

For a fifth year running, silver supply (mining plus recycling) fails to meet industrial and investment demand, particularly from sectors like solar and EVs. Disruptions in mining and refining could tighten supply further.

4. Record ETP Inflows

In H1 2025, cumulative net inflows into silver ETPs reached 95 million ounces—already surpassing 2024’s totals—with total holdings climbing to 1.13 billion ounces, just 7% below the February 2021 peak. June alone accounted for nearly half of the inflows, the largest monthly surge since the 2021 Reddit-driven rally.

5. Macro Tailwinds

- Rate Outlook: Ongoing trade-headline volatility and moderation in inflation could prompt the Fed to begin easing later in 2025.

- Dollar Pressure: Tariff and growth concerns are weighing on the U.S. dollar, bolstering demand for dollar-denominated assets like silver.

Sources:

Reuters, The Silver Institute, Mining.com, FXStreet, GlobeNewswire, Futunn, CaratX, TrotterInc, InvestingNews and Kitco

Written by: Dhruv Joglekar