Navigating Uncertainty: How the Iran-Israel War Threatens India’s Trade Flows

Synopsis: The ongoing Iran-Israel conflict poses significant risks to India’s trade, especially due to rising crude oil prices, disruptions in shipping routes, and increased insurance and freight costs.

As tensions between Iran and Israel escalate, the economic tremors are being felt far beyond the Middle East. For India—deeply integrated into global trade and heavily reliant on energy and fertilizer imports—the conflict poses serious macroeconomic and sectoral challenges. Disruptions in shipping lanes, rising freight costs, and supply chain vulnerabilities are already beginning to strain key industries.

Trade Disruption and Export Exposure

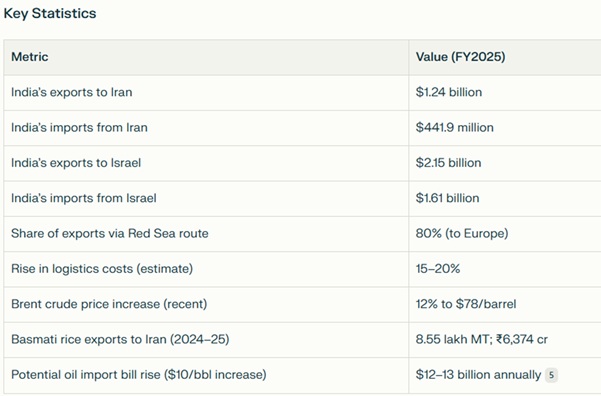

In FY2025, India exported goods worth $1.24 billion to Iran and $2.15 billion to Israel, while importing $441.9 million and $1.61 billion from these countries, respectively. However, the broader threat lies in the disruption of key maritime routes.

The Strait of Hormuz and the Red Sea—which together handle nearly 80% of India’s merchandise trade with Europe and a significant portion of trade with the US—are now under threat. These regions account for 34% of India’s total exports.

Map of Strait of Hormuz: Wikipedia

Source: commerce.gov.in

Risk to Indian Export

- War risk premiums for containers have surged from $50–$200 to $200–$400.

- Transit times via the Cape of Good Hope are increasing by 15–20 days, raising freight and insurance costs by a similar margin.

- India’s exports to Israel have already dropped from $4.5 billion in FY24 to $2.1 billion in FY25, while imports fell from $2.0 billion to $1.6 billion.

Sectoral Impact

Several of India’s high-performing export sectors are particularly vulnerable:- Pharmaceuticals, which rely on stable access to Middle Eastern and North African markets.

- Textiles and home furnishings, especially to Israel, where margins are 10–15% higher than in the US.

- Gems and jewellery, electronics, and engineering goods, which face both demand-side risks and supply-side shocks—particularly from disruptions in Israel’s rough diamond exports.

- Basmati rice exports to Iran, India’s third-largest buyer, are expected to decline. In FY25, India exported ₹6,374 crore worth of Basmati rice to Iran, accounting for 12.6% of total Basmati exports.

Fertilizer Sector: A Fragile Supply Chain

India’s fertilizer sector is especially exposed due to Iran-Israel war. Nitrogen fertilizers like urea depend on ammonia, derived from natural gas—60% of production costs stem from this input. Phosphorus fertilizers like Diammonium Phosphate (DAP) require phosphate rock and sulphur, while potassium fertilizers rely on potash ore. Global fertilizer Supply:- The Middle East and North Africa (MENA) region supplies over 30% of the world’s nitrogen fertilizers.

- Iran exports over 16 million tonnes of urea annually.

- Morocco holds 70% of global phosphate rock reserves.

- Russia and Belarus account for nearly 40% of global potash capacity.

Prices of Di-ammonium Phosphate (DAP) and Urea USD/T on June 17, 2025

Ripple Effects in India

The Indian government may be forced to increase fertilizer subsidies, straining the fiscal deficit. If subsidies are not scaled up, food inflation could rise, especially in rural areas. The war could lead to rise in Energy Prices and Inflationary Pressure. The conflict has already pushed Brent crude oil prices to $76 per barrel, with a 12% surge since the escalation began. JPMorgan warns that prices could reach $120 per barrel in a worst-case scenario. A $10 increase in crude oil raises India’s oil import bill by ~ $12–13 billion annually, widening the current account deficit by ~ 0.3% of GDP. The Indian rupee has already weakened to ~ ₹86 per USD, adding to import costs. Higher oil prices could also impact sectors like paints, tyres, cement, and chemicals, which rely on crude derivatives.Written by: Deepak Pawar