India’s Naval Build-Up: The Rise of a Strategic Shipbuilding Power

Setting the Context: Why Naval Power Matters More Than Ever

India’s defence shipbuilding sector is entering a long-term growth phase, evolving from a strategically reserved sector into a key pillar of national security and manufacturing. Backed by a strong naval modernisation pipeline and policy support, this shift is strengthening maritime deterrence and reducing import dependence.

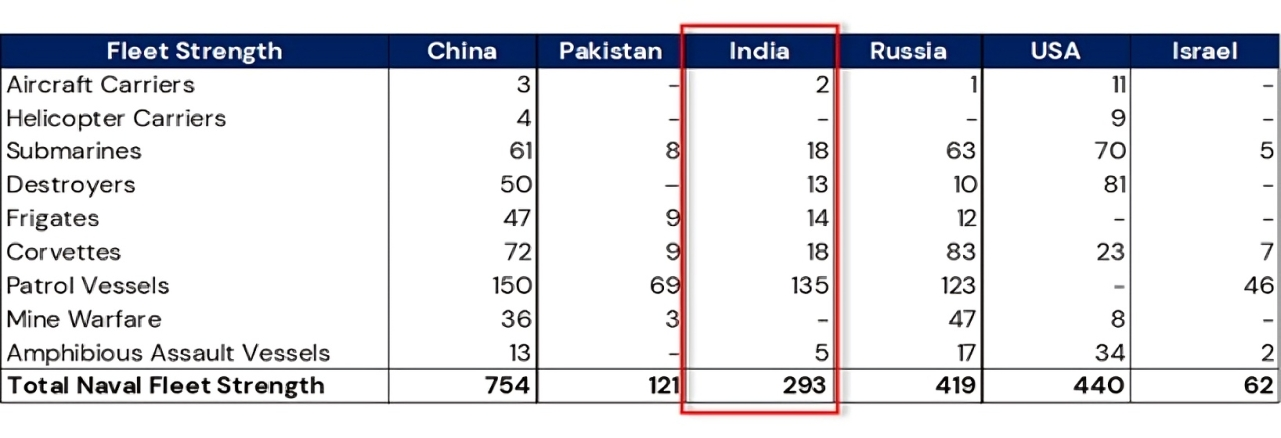

The Global Naval Balance: Where India Stands Today

While India operates a balanced naval fleet, its overall strength remains significantly smaller than that of China, the United States, and Russia. This gap underlines the need for sustained and long-term naval expansion.

Two-Front Maritime Reality: The China-Pakistan Axis

India’s maritime security is increasingly shaped by a two-front challenge, driven by China’s growing presence in the Indian Ocean and Pakistan’s expanding naval capabilities. This coordinated pressure raises the need for stronger sea-lane control, credible deterrence, and a larger, more technologically advanced naval fleet.

Present Naval Capability and the Target Fleet Vision

While India’s warship fleet is currently modest, it is expanding rapidly. With over 60 ships under construction, 70-80 more planned, and a target of ~175-200 warships by 2035, India is undertaking one of its largest naval buildouts- focused on indigenised, high-value platforms rather than just numbers.

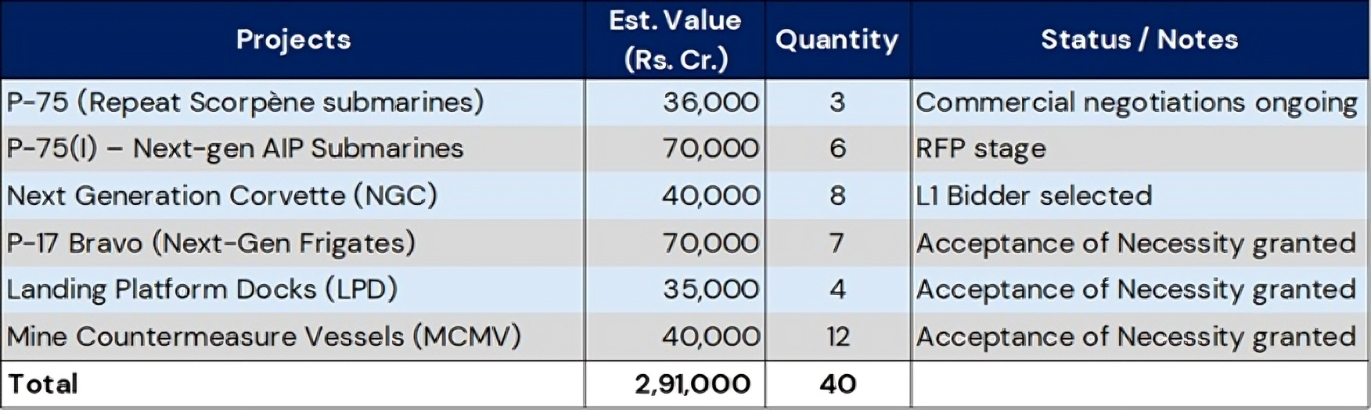

The Next Decade of Shipbuilding: Major Platforms in the Pipeline

Over the next decade, India’s naval shipbuilding pipeline spans submarines, frontline warships, amphibious vessels, and support platforms- together representing an opportunity of nearly Rs. 3 lakh crores. The navy is now ordering entire ship classes in larger numbers, signalling a shift from one-off projects to continuous fleet expansion and long-term visibility.

Policy as a Force Multiplier: Government Push Behind the Sector

Defence shipbuilding push is driven by a clear policy framework, not demand alone. Reforms under the Defence Acquisition Procedure (DAP) prioritise domestic procurement, higher indigenous content, and long-term contracts, while supporting technology transfer and defence exports. Together, these policies are strengthening India’s shipbuilding ecosystem.

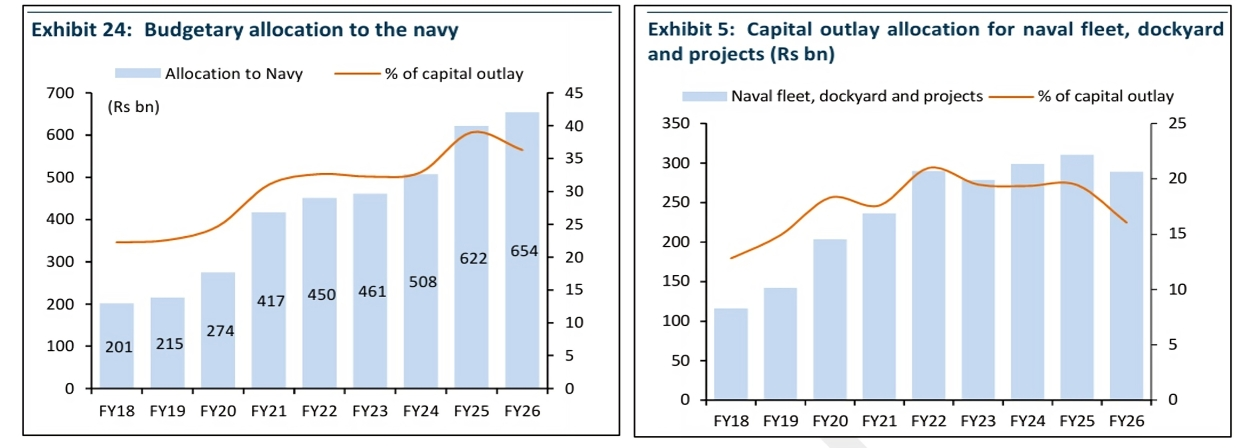

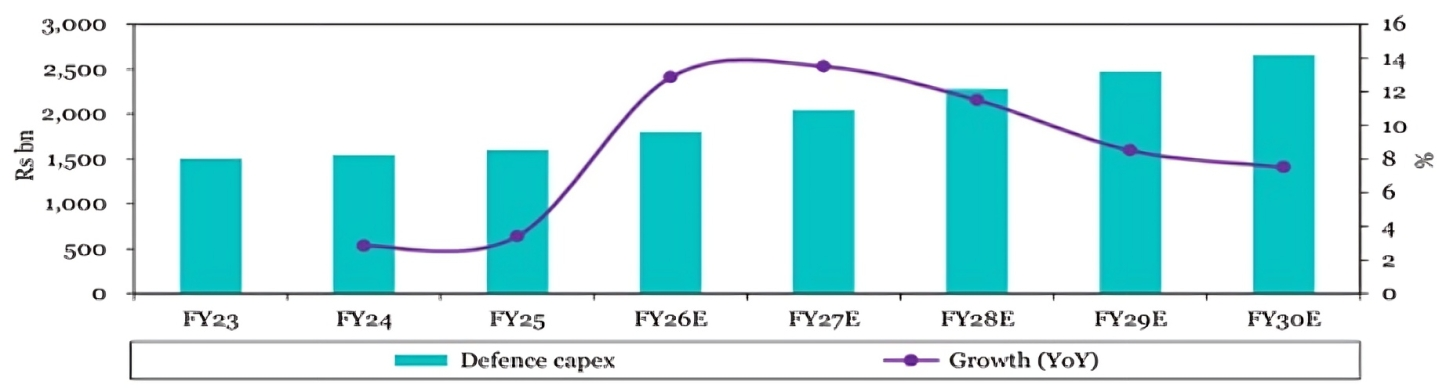

Following the Money: Defence and Naval Capex on a Structural Uptrend

Naval modernisation is now firmly backed by rising capital allocation. Naval capex has more than doubled since FY18, while warship procurement has nearly tripled- raising the navy’s share of defence capital outlay to the mid-teens. This sustained increase shows that shipbuilding is a long-term strategic priority, not a cyclical spends.

This naval expansion sits within a structurally rising defence capex cycle. Capital expenditure now makes up around 20-25% of total defence spending and is expected to grow at a high-teens pace, with the navy’s share steadily increasing to support fleet renewal and shipbuilding.

Beyond Steel and Hulls: Indigenisation, Technology & Electronics

Modern warships are highly complex systems that combine propulsion, sensors, weapons, and software into a single combat platform. India has moved well beyond hull construction to successfully design and integrate many of these systems, with warships showing strong execution and design maturity.

Indigenous content has risen from under 30% in the early 2000s to ~70% in current destroyers and frigates, with upcoming platforms targeting up to 90%. Importantly, electronics now account for ~ 30–40% of a warship’s value- covering combat management systems, radars, sonars, EW, communications – many of which are increasingly developed domestically.

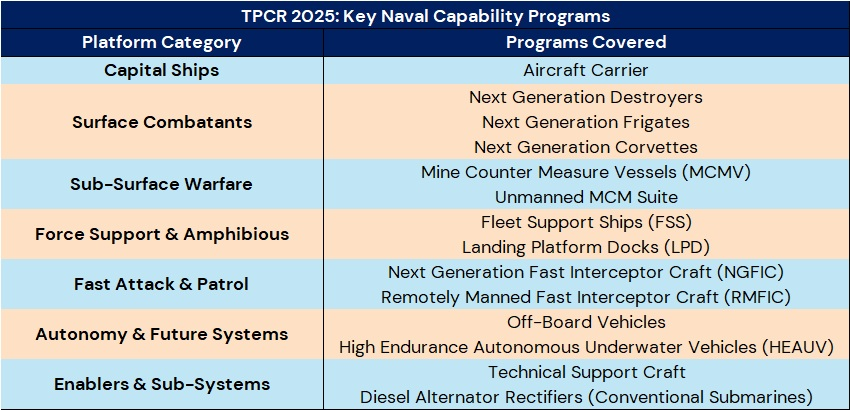

Import dependence is being reduced through higher indigenisation, technology transfer with global peers, and rising domestic R&D. This shift is guided by the Technology Perspective and Capability Roadmap (TPCR), a 15-year blueprint issued by India’s Ministry of Defence that aligns shipbuilding with future technologies such as advanced propulsion, autonomy, sensors and EW, steering India toward a technology-driven, self-reliant, and future-ready naval force.

Unlocking the Non-Defence Opportunity in Shipbuilding

Beyond defence, commercial shipbuilding and ship repair offer a strong adjacent opportunity to Indian shipyards. Despite handling nearly 95% of India’s trade by sea, India accounts for less than 1% of global commercial shipbuilding.

To bridge this gap, the government has launched a Rs. 70,000 crore Shipbuilding & Maritime Development package, granted infrastructure status, and introduced financial assistance and interest subvention, and is developing coastal shipbuilding and repair clusters to improve competitiveness and scale MRO activity.

Sources: Industry research reports, company disclosures, government publications, and official press releases.

Written By : Harshit Dand

This article is published for informational purposes only and does not constitute investment advice or analysis. The information presented has been sourced from public domains and has not been independently verified. Vasuki Group makes no representations or warranties regarding the accuracy, completeness, timeliness, or reliability of the content. Neither Vasuki Group nor its affiliates, directors, employees, or representatives shall be liable for any errors, omissions, or reliance on the information provided. This article does not constitute an offer, solicitation, or recommendation for any investment, securities transaction, or contractual engagement. Readers should conduct their own due diligence before making any financial decisions. Any views expressed are those of the author and do not necessarily reflect the opinions of Vasuki Group. Further, Vasuki Group may hold or take positions in the market that differ from the views expressed in this article. All rights reserved. Vasuki Group reserves the right to update or modify this article at its discretion. For more information, reach out to us on research@vasukiindia.com.